CA DE 2063 2010-2026 free printable template

Show details

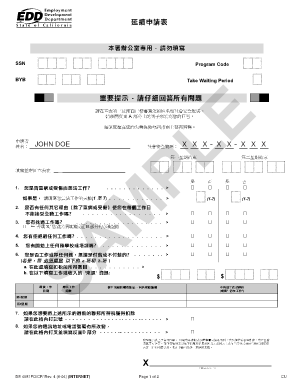

NOTICE OF REDUCED EARNINGS LAST NAME FIRST NAME SOCIAL SECURITY NUMBER NOTE Issue a DE 2063 only for the seven-consecutive-day period corresponding to your payroll week. If you pay your workers less often than once each seven days you must issue a DE 2063 for each calendar week Sunday through Saturday of partial unemployment. PLEASE ANSWER ALL OF THE FOLLOWING QUESTIONS* EDD USE ONLY Interviewer s Initial AC EMPLOYER S STATEMENT FOR THE PAYROLL WEEKENDING DATE MM/DD/YY 1. Gross earnings...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign notice of reduced earnings de 2063 or de 2063f form

Edit your de2063 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of reduced earnings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of reduced earnings de 2063 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit de2063 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out de 2063 form

How to fill out CA DE 2063

01

Obtain the CA DE 2063 form from the California Employment Development Department (EDD) website or local office.

02

Fill in your personal information including your full name, address, and social security number.

03

Provide details about your unemployment insurance claim or disability claim as required.

04

Indicate the reason for filing the form by selecting the appropriate options.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form to certify the information provided.

07

Submit the form via the specified method—either online, by mail, or in person—as instructed.

Who needs CA DE 2063?

01

Individuals who are applying for unemployment insurance benefits in California.

02

Workers who need to report changes in their employment status to the EDD.

03

Those seeking to claim disability benefits or other related services from the EDD.

Fill

de 2063 or de 2063f

: Try Risk Free

People Also Ask about edd reduced hours form

What disqualifies you from unemployment in California?

"An individual is disqualified for unemployment compensation benefits if the director finds that he or she left his or her most recent work voluntarily without good cause or that he or she has been discharged for misconduct connected with his or her most recent work."

What are the rules for collecting unemployment in California?

When applying for unemployment benefits, you must: Have earned enough wages during the base period. Be totally or partially unemployed. Be unemployed through no fault of your own. Be physically able to work. Be available for work. Be ready and willing to accept work immediately.

Can I collect unemployment if my salary is reduced in California?

California Partial Unemployment Benefits Whether you were laid off and do occasional odd jobs or you are still employed at reduced pay and hours, you can collect benefits if you meet the above requirements. The employer must complete a "Notice of Reduced Earnings" form, and the employee must fill out part of the form.

Can I collect unemployment if my hours are reduced California?

You may file a claim for UI benefits if you are out of work or your hours have been reduced. To be eligible to receive UI benefits, you must be out of work due to no fault of your own and be physically able to work, ready to accept work, and looking for work.

How much money can you make and still collect unemployment in California?

This means that the first $25 or 25 percent (which is greater) of the wages allocated to a week will be disregarded. The amount remaining (i.e., earnings over $25 or 75 percent of the earnings, whichever is smaller) is deducted from the claimant's weekly benefit amount.

What is a good reason to quit your job and collect unemployment in California?

Domestic Circumstances. This section discusses the principles of eligibility when the claimant has voluntarily quit employment for reasons associated with domestic circumstances including care of the home or children, illness or death in the family, marriage, separation, reconciliation, and divorce.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my obtain the ca de 2063 form from the unemployment insurance claim or disability claim as required in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your pma 2063 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit de 2063f online?

The editing procedure is simple with pdfFiller. Open your edd provides employers with a employees in the fishing in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in form de 2063 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing employer's and claimant's work sharing certification work sharing de 4581ws and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is CA DE 2063?

CA DE 2063 is a form used in California for reporting certain tax liabilities, specifically related to the tax obligations of individuals and businesses within the state.

Who is required to file CA DE 2063?

Individuals and businesses that have specific tax liabilities or income subject to California state tax must file CA DE 2063.

How to fill out CA DE 2063?

To fill out CA DE 2063, applicants should provide their personal information, tax identification number, relevant income details, and any applicable deductions. It is advisable to follow the instructions provided on the form or consult a tax professional.

What is the purpose of CA DE 2063?

The purpose of CA DE 2063 is to ensure proper reporting and compliance with California tax laws, allowing the state to assess and collect taxes accurately.

What information must be reported on CA DE 2063?

Information that must be reported on CA DE 2063 includes taxpayer identification information, total income, tax deductions, credits, and any other relevant financial data required for accurate tax assessment.

Fill out your CA DE 2063 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Did Your Employer Union Or Non Union Trade Association Give You One Of These Unemployment Forms Notice Of Reduced Earnings De 2063 Or De 2063f Pacific Maritime Association Partial Evidence Of Payment Form Pma 2063 Employer's And Claimant's Work Sha is not the form you're looking for?Search for another form here.

Keywords relevant to 2063

Related to 2063f

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.